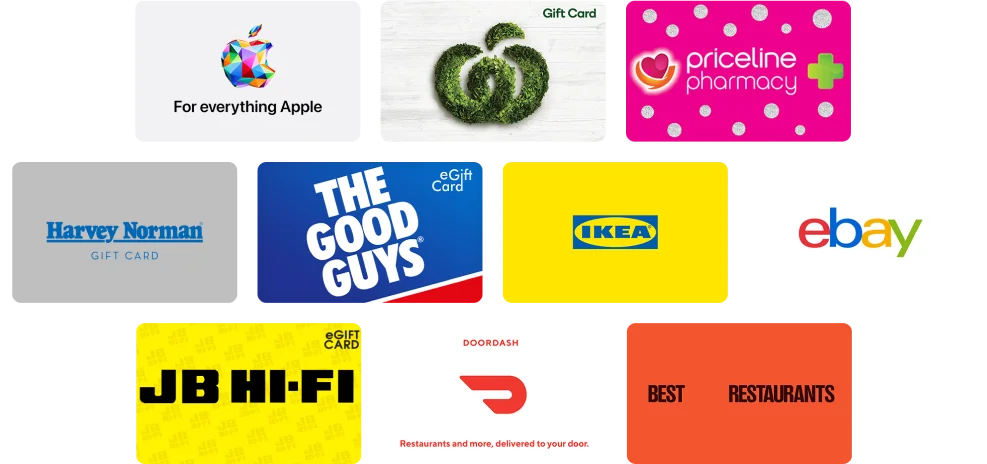

All your favourite brands are here

Important information

1 Subject to eligibility requirements, we will issue you a redeemable amount in the form of Latitude Rewards equivalent to 3% of eligible purchases. You can use this amount to select an e-gift card via the Latitude App and Latitude Service Centre.

Eligible purchases are determined based on transactions posted to the account. Eligible transactions are transactions that are directly setup as recurring payments with participating merchants under the following merchant categories codes (MCC):

- Utilities (Electricity, Gas, Water) - 4900

- Telco Services – 4812 and 4814

- Streaming Services – 4899, 5735, and 5815

Exclusions to eligible transactions apply.

Merchant categories are determined by a merchant’s Merchant Category Code (MCC). We are not responsible for designating MCCs and have no control over the same. You’re unable to receive rewards if you use an intermediary platform such as PayPal, Google and the like.

The Latitude Rewards will be issued by EonX Services Pty Ltd and will be available for redemption via the Latitude App or Latitude Service Centre within 30 days from the end of the statement period. The primary cardholder has up to 18 months to redeem from the date of issue. View Latitude Rewards Program Terms and Conditions.

2 E-Commerce Purchase Protection Insurance is underwritten and issued by AIG Australia Limited ABN 93 004 727 753, AFSL 381 686, Level 19, 2 Park Street, Sydney NSW 2000 (“AIG”) under a group policy of insurance issued to Mastercard. In arranging the insurance Mastercard acts a group purchasing body under ASIC Corporations (Group Purchasing Bodies) Instrument 2018/751. Eligible Persons who can access the complimentary e-commerce purchase protection insurance are Latitude customers who hold the relevant credit card which entitles them to these e-commerce purchase protection insurance benefits. It is important you read your Latitude credit card e-commerce purchase protection insurance Terms and Conditions and consider whether the insurance is right for you. You will need to obtain your own independent advice about the insurance or and whether it is appropriate for you. Eligible persons can claim as third-party beneficiaries by virtue of the operation of s48 of the Insurance Contracts Act 1984. Conditions and Exclusions apply to this insurance coverage as set out in the group policy and any insurance document provided to the eligible persons and which both may be amended from time to time. Neither Latitude Finance Australia nor Mastercard guarantees this insurance and do not hold an Australian Financial Services Licence. View full terms and conditions.

3 Up to $300 in Latitude Rewards offer is available to new and approved Latitude Low Rate Mastercard customers from 20 November 2024 to 28 February 2025 and is limited to one offer per customer. Customer must choose the offer to be eligible. $50 Latitude Rewards will be credited to a customer’s Latitude Rewards balance every statement period when they spend $1,000 or more on eligible transactions in the first 6 months from card approval. Eligible transactions are based on the date posted and do not include cash advances, cash equivalent transactions, card fees or charges, credits, refunds, reimbursements, interest and balance transfers into an account. The account must be open and not in default of the credit contract when the redeemable amount is issued. The $50 Latitude Rewards will be issued by EonX Services Pty Ltd and will be available for redemption via the Latitude App or Latitude Service Centre within 60 days of meeting the spend criteria. The primary cardholder has up to 18 months to redeem from the date of issue. We reserve the right to close or vary this offer at any time.

4 Balance transfer applies to eligible customer's Australian non-Latitude credit cards only. Balance transfer amounts commencing from $500 or more, up to 85% of your Latitude Low Rate Mastercard credit card credit limit. Monthly payments required (exact amounts specified in your statement). Paying only the minimum monthly payment may not pay out the balance transfer amount before the end of the promotional period. If there is an outstanding balance after the promotional period, interest will be charged at the cash annual percentage rate, currently 29.99% (subject to change). A once-off balance transfer fee of 3% applies to the amount being transferred. This will be charged to your Latitude Low Rate Mastercard credit card account when the balance transfer is processed.

New customers only and must be approved from 20 November 2024 to 28 February 2025. We reserve the right to close or vary this offer at any time.

Latitude General Terms and Conditions set out the T&Cs of the Latitude Low Rate Mastercard credit card. Credit provided by Latitude Finance Australia ABN 42 008 583 588 Australian Credit Licence number 392145.

Woolworths Group Limited ABN 88 000 014 675 is the issuer of the Woolworths Supermarket Gift Card, but is not the promoter of the offer, nor responsible for fulfilment of the offer terms. Woolworths Supermarket eGift Cards have no expiry date and are redeemable at participating stores only. For a list of participating stores and full Gift Card Terms andcConditions visit woolworths.com.au/giftcards.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, Safari, and Touch ID are trademarks of Apple Inc., and App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

Google Pay, Android, the Google Pay Logo, Google Play and the Google Play logo are trademarks of Google LLC.

®Registered to BPAY Pty Ltd ABN 69 079 137 518.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.