Latitude Low Rate Mastercard

Low rate, High rewards.

- Get up to $300 in bonus Latitude Rewards12 when you spend $1,000 or more on eligible transactions every statement period in your first 6 months from approval. T&Cs apply.

- Get 0% p.a. for 18 months on balance transfers13.

3% balance transfer fee applies. T&Cs apply. - Our lowest rate credit card offer.

- Get 3% back in Latitude Rewards14 when you set up recurring payments direct with participating utilities, telco, and streaming services. T&Cs apply.

- Unlock offers and discounts from 100s of your favourite merchants.

- Up to 55 days interest free* on general purchases.

Latitude 28° Global Platinum Mastercard

The travel card that loves shopping at home and away!

- Get $300 bonus Latitude Rewards when you spend $1,000 or more on eligible transactions every statement period for your first 3 months from approval14.

- Get $0 monthly card fee for your first 12 months from approval15.

- Shop and be rewarded with the Latitude Rewards Program

- Complimentary E-Commerce Protection and Purchase Protection Insurances

- Amazing everyday and travel offers

- Great foreign exchange rates set by Mastercard

Latitude GO Mastercard

An everyday credit card with the flexibility of Interest Free payment plans.

- Stay on top of your spending with the Latitude App. It makes it easy to manage your account and make repayments in just a few taps.

- Long term Interest Free Plans at Harvey Norman and other fantastic retailers1.

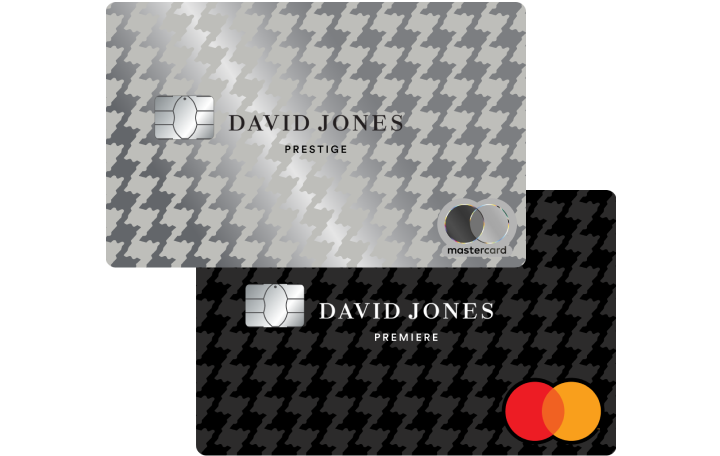

David Jones credit cards

Access to unrivalled services, exclusive benefits and iconic experiences like no other; unlocked while you shop.

- Earn David Jones Points every time you shop6

- Use your points to purchase your favourite items at David Jones, redeem for gift cards and more7

- Gain access to exclusive benefits such as VIP sales and previews8, complimentary express delivery9 and gift wrapping10 at David Jones

Important information

'INTEREST FREE PLANS' CREDIT CARD PRODUCTS

*To take advantage of up to 55 days Interest Free on everyday credit card purchases, you need to pay the full closing balance on each statement of account by the applicable due date.

1 Extended Interest Free terms may vary. Available at participating retailers to approved applicants only. Conditions, fees and charges apply.

2 To take advantage of up to 55 days interest free on everyday credit card purchases, you need to pay the full closing balance (excluding un-expiring 0% Interest Payment Plans) on each statement of account by the applicable due date.

3 T&Cs, card fee & other charges apply. Minimum spend and exclusions may apply. Minimum monthly payments required.

5 Extended Interest Free terms may vary. Available at Apple Retail Stores & the Apple Online Store. Online purchases must be made via Apple Telesales on 133 622. Approved applicants only. Conditions, fees and charges apply.

Interest free payment plans may vary depending on the promotional type, interest free promotional term and promotion conditions. T&C's, fees, charges, and product exclusions apply. Amount payable will be shown on your monthly statement.

Interest free terms may vary at participating retailer. Refer to retailer or Latitude websites for more information.

Interest and payments are payable after the interest free period expires if you do not adhere to conditions of the interest free plan. At the end of the plan, interest will be charged at 29.99% p.a. (subject to change) to any remaining balance on the expiry of the interest free term. Monthly account service fee $10.95 (subject to change) applies. Interest may also apply to other credit card transactions, or if you do not comply with the T&C's. The Conditions of Use (as applicable) specify all other conditions for this offer. Also available on other participating Latitude Credit Cards. Credit provided by Latitude Finance Australia ABN 42 008 583 588 Australian Credit Licence number 392145.

'REWARDS' CREDIT CARD PRODUCTS

6 Earning of David Jones Points are governed by the David Jones Prestige and Premiere credit cards. Terms and Conditions are stated in the Conditions of Use. For full Terms and Conditions click here. David Jones Points are earned for every Australian dollar spent on goods and services and are subject to your account being kept in good standing and not overdue or in default.

7 Redemption of David Jones Points is subject to the David Jones Premiere and Prestige credit card Conditions of Use. The amount of David Jones Points required to purchase the item(s) is subject to change at any time. Minimum number of points apply for each type of redemption. Only Primary cardholder is eligible to redeem the David Jones Points. Gift cards are not refundable, may not be exchanged for cash or credit and are valid for a period of 36 months from the date of issue, unless otherwise stated. Points for credit will be applied as a payment to your account and cannot be reversed. Points for credit can be requested to cover a purchase within 30 days of the purchase date.You may specify a number of points to redeem in order to pay for a purchase during checkout at David Jones online.

8 To receive exclusive invitations and discounts you must be opted in to receive marketing communications and continue to spend on your David Jones Premiere or Prestige credit card. Subject to availability.

9 To be eligible to receive complimentary express delivery to any address within Australia you must purchase at David Jones online using your David Jones Premiere or Prestige credit card. Items must be under 25kg and no larger than 1m x 1m x 1.5m. Excludes gift cards, hampers and fresh food, Wine Club, Gift Registry purchases and large items. Refer to www.davidjones.com/delivery-choices for available delivery options offered by David Jones and all eligibility conditions. Delivery options may change during peak periods.

10 Available whenever you purchase using a David Jones Premiere or Prestige credit card instore or online at davidjones.com. Complimentary gift wrap services are not available for larger items and may be limited during peak periods.

14 Subject to eligibility requirements, we will issue you a redeemable amount in the form of Latitude Rewards equivalent to 3% of eligible purchases. You can use this amount to select an e gift card via the Latitude App and Latitude Service Centre. Eligible purchases are determined based on transactions posted to the account. Eligible transactions are transactions that are directly setup as recurring payments with participating merchants under the following merchant categories codes (MCC):

- Utilities (Electricity, Gas, Water) 4900

- Telco Services 4812 and 4814

- Streaming Services 4899, 5735, and 5815

Merchant categories are determined by a merchant s Merchant Category Code (MCC). We are not responsible for designating MCCs and have no control over the same. You re unable to receive rewards if you use an intermediary platform such as PayPal, Google and the like. The Latitude Rewards will be issued by EonX Services Pty Ltd and will be available for redemption via the Latitude App or Latitude Service Centre within 30 days from the end of the statement period. The primary cardholder has up to 18 months to redeem from the date of issue. View Latitude Rewards Program Terms and Conditions

GENERAL DISCLOSURES

11 Excludes long-term Interest Free payment plans. Other exclusions, T&Cs, card fee & other charges apply. Limited to new and approved Latitude Gem Visa applicants only. Limited to one offer per applicant. To qualify for $200 credit back, you must be approved and fulfil on the terms of the offer by spending $1,000 or more each month on everyday purchases for 3 consecutive months from the date of approval. The $200 credit will be applied within 60 days of meeting the spend criteria. Offer ends 15 Dec 2024. Latitude may vary, extend or withdraw this offer at any time without notice. Everyday purchases do not include cash advances, cash equivalent transactions, card fees or charges, credits, refunds, reimbursements, Long term Interest Free plan(s), interest and balance transfers into an account. Transactions must be fully processed and any pending transactions at the end of the period will not count towards the spend criteria for that period. The account must be open and not in default of the credit contract when the credit is applied.

12 Up to $300 in Latitude Rewards offer is available to new and approved Latitude Low Rate Mastercard customers from 20 November 2024 to 28 February 2025 and is limited to one offer per customer. Customer must choose the offer to be eligible. $50 Latitude Rewards will be credited to a customer s Latitude Rewards balance every statement period when they spend $1,000 or more on eligible transactions in the first 6 months from card approval. Eligible transactions are based on the date posted and do not include cash advances, cash equivalent transactions, card fees or charges, credits, refunds, reimbursements, interest and balance transfers into an account. The account must be open and not in default of the credit contract when the redeemable amount is issued. The $50 Latitude Rewards will be issued by EonX Services Pty Ltd and will be available for redemption via the Latitude App or Latitude Service Centre within 60 days of meeting the spend criteria. The primary cardholder has up to 18 months to redeem from the date of issue. We reserve the right to close or vary this offer at any time

13 Balance transfer applies to eligible customer s Australian non Latitude credit cards only. Balance transfer amounts commencing from $500 or more, up to 85% of your Latitude Low Rate Mastercard credit card credit limit. Monthly payments required (exact amounts specified in your statement). Paying only the minimum monthly payment may not pay out the balance transfer amount before the end of the promotional period. If there is an outstanding balance after the promotional period, interest will be charged at the cash advance rate, currently 29.99% (subject to change). A once off balance transfer fee of 3% applies to the amount being transferred. This will be charged to your Latitude Low Rate Mastercard credit card account when the balance transfer is processed. New customers only and must be approved from 20 November 2024 to 28 February 2025. We reserve the right to close or vary this offer at any time. Latitude General Terms and Conditions set out the T&Cs of the Latitude Low Rate Mastercard credit card. Credit provided by Latitude Finance Australia ABN 42 008 583 588 Australian Credit Licence number 392145

15$300 Latitude Reward is available to new and approved applicants by 28 May 2025 who apply for a Latitude 28° Global Platinum Mastercard and is limited to one offer per applicant. To qualify, you must be approved and fulfil on the terms of the offer by spending $1,000 or more on eligible transactions each statement period for 3 months from the date of your approval. Any purchases made by an additional cardholder will contribute towards the primary cardholder's spend threshold. Eligible transactions are based on the date posted and do not include cash advances, cash equivalent transactions, card fees or charges, credits, refunds, reimbursements, Shopper's Protection premiums, interest and balance transfers into an account. The account must be open and not in default or the credit contract when the redeemable amount is issued. The Latitude Rewards will be issued by EonX Services Pty Ltd and will be available for redemption via the Latitude App or Latitude Service Centre within 30 days of meeting the spend criteria. The primary cardholder has up to 18 months to redeem from the date of issue. Latitude may vary, extend or withdraw this offer at any time without notice.

16$0 Monthly Card fees for your first 12 months is available to new and approved applicants by 28 May 2025 who apply for a Latitude 28° Global Platinum Mastercard and is limited to one offer per applicant. After the first year, the monthly card fee reverts to $8 per month (subject to change) and will be debited to your card account on your first statement following your 12-month anniversary and monthly thereafter. Latitude may vary, extend or withdraw this offer at any time without notice

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, Safari, and Touch ID are trademarks of Apple Inc., and App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

Google Pay, Android, the Google Pay Logo, Google Play and the Google Play logo are trademarks of Google LLC.

®Registered to BPAY Pty Ltd ABN 69 079 137 518.

Visa and the Visa brand are registered trademarks of Visa International.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Credit and lending criteria apply to this credit card. Refer to product Conditions of Use for more information.

![Get $300 Bonus Latitude Rewards,[object Object]](/static/herobanner-bonus-latitude-rewards-4c3bfcabd918208795eb9b7c98c81e68.webp)

![Enjoy $0 monthly card fee,[object Object]](/static/herobanner-monthly-card-fees-8784772bb1025b4ebb69c0613e450a8e.webp)